Takehome paycheck calculator

Calculate your take home pay after taxes. No api key found.

Payroll Calculator Free Employee Payroll Template For Excel

Take-home pay or wages are what is left over from your wages after withholdings for taxes.

. Federal Income Tax Calculator Calculate your federal state local income taxes Updated for. How much youre actually taxed depends on various factors such as your marital. Some states follow the federal tax.

Paycheck Calculator Take Home Pay Calculator. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Take home paycheck calculator use this calculator to estimate the actual paycheck amount that is brought home after taxes.

When you make a pre-tax contribution to your. Just enter the wages tax withholdings and other information required. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Free salary hourly and more paycheck calculators. Federal Salary Paycheck Calculator. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Use ADPs Minnesota Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Important Note on Calculator.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. Your take-home pay is the difference between your gross pay and what you get paid after taxes are taken out.

The Viventium Paycheck Calculator is a free tool that will calculate your net or take-home pay. To calculate your annual salary multiply your gross pay your pay before before tax deductions by the number of pay periods per year. The latest budget information from April 2022 is used to.

Your employer withholds a 62 Social Security tax and a. For example if you receive a weekly. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide.

The state tax year is also 12 months but it differs from state to state. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

Tax Payroll Calculator Shop 59 Off Www Wtashows Com

How To Calculate Payroll For Hourly Employees Sling

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Sample Resume

Payroll Calculator Free Employee Payroll Template For Excel

Tax Payroll Calculator Shop 59 Off Www Wtashows Com

Payroll Calculator Free Employee Payroll Template For Excel

Tax Payroll Calculator Shop 59 Off Www Wtashows Com

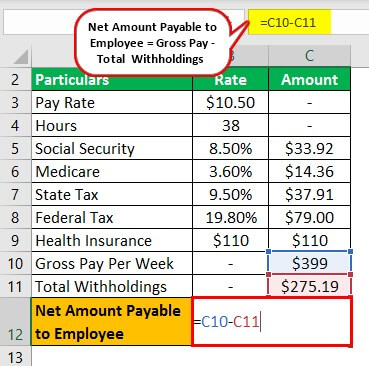

Payroll Formula Step By Step Calculation With Examples

Tax Payroll Calculator Shop 59 Off Www Wtashows Com

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Tax Payroll Calculator Shop 59 Off Www Wtashows Com

Tax Payroll Calculator Shop 59 Off Www Wtashows Com

Tax Payroll Calculator Shop 59 Off Www Wtashows Com

Paycheck Calculator Take Home Pay Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Payroll Calculator Free Employee Payroll Template For Excel